Embark on a journey through the fascinating world of Mergers and Acquisitions, where companies unite, strategies align, and success stories unfold. As we delve into the intricacies of this business realm, prepare to be captivated by the dynamics, challenges, and triumphs that shape the landscape of M&A.

From defining the essence of mergers and acquisitions to exploring the nuances of cultural integration, this exploration promises to be a rollercoaster of insights and revelations. Let’s dive in together and unravel the mysteries behind the art of corporate unions.

Overview of Mergers and Acquisitions

Mergers and acquisitions (M&A) are strategic business activities that involve the combination of two companies to create a new entity or the purchase of one company by another. These transactions are typically undertaken to achieve synergies, increase market share, diversify product offerings, or gain a competitive edge in the market.

Define Mergers and Acquisitions

Mergers refer to the joining of two companies to form a new entity, where both companies’ assets and liabilities are combined. On the other hand, acquisitions involve one company purchasing another, resulting in the acquired company becoming a subsidiary of the acquiring company.

Successful Mergers and Acquisitions Examples

- Disney’s acquisition of 21st Century Fox: In 2019, Disney acquired 21st Century Fox for $71.3 billion, expanding its entertainment portfolio with popular franchises like X-Men and Avatar.

- Amazon’s acquisition of Whole Foods: In 2017, Amazon acquired Whole Foods for $13.7 billion, allowing the e-commerce giant to enter the grocery market and strengthen its physical retail presence.

- Microsoft’s acquisition of LinkedIn: In 2016, Microsoft acquired LinkedIn for $26.2 billion, integrating the professional networking platform into its suite of productivity tools.

Reasons for Mergers and Acquisitions

Mergers and acquisitions are strategic business decisions made by companies for various reasons. These transactions can help companies achieve growth, expand market share, improve operational efficiency, or enter new markets. Let’s explore the key reasons behind companies opting for mergers and acquisitions.

Strategic Reasons for Mergers and Acquisitions

Mergers and acquisitions are often driven by the strategic objectives of companies. Some common strategic reasons include:

- Market Expansion: Companies may merge or acquire other firms to expand their presence in new markets or regions.

- Increased Market Share: Combining forces with another company can help increase market share and competitiveness.

- Diversification: Mergers and acquisitions can help companies diversify their product offerings or services, reducing reliance on a single market segment.

- Synergies: By combining resources, companies can achieve cost savings, increased efficiency, and revenue growth through synergies.

Growth through Mergers and Acquisitions

Mergers and acquisitions play a crucial role in enabling companies to achieve growth in various ways. Some ways in which companies can grow through mergers and acquisitions include:

- Rapid Expansion: Mergers and acquisitions allow companies to rapidly expand their operations, customer base, and market reach.

- Access to New Technologies: Acquiring a company with advanced technologies can help a company stay ahead of the competition and drive innovation.

- Talent Acquisition: Mergers and acquisitions can also help companies acquire top talent and expertise in specific areas, boosting their capabilities.

Horizontal Mergers vs. Vertical Mergers

Horizontal mergers involve the consolidation of companies operating in the same industry or offering similar products or services. The motivations behind horizontal mergers include:

- Eliminating Competition: Horizontal mergers can help companies eliminate competition and gain a larger market share.

- Cost Synergies: By combining operations, companies can achieve cost synergies and improve efficiency.

On the other hand, vertical mergers involve the integration of companies operating at different stages of the supply chain. The motivations behind vertical mergers include:

- Control over Supply Chain: Vertical mergers allow companies to have more control over their supply chain, ensuring smooth operations and quality control.

- Cost Reduction: By vertically integrating, companies can reduce costs associated with intermediaries and improve overall profitability.

Types of Mergers

Horizontal, vertical, and conglomerate mergers are the three main types of mergers that companies can engage in to achieve various strategic goals.

Horizontal Merger

A horizontal merger occurs when two companies operating in the same industry and at the same stage of the production process combine forces. This type of merger aims to increase market share, reduce competition, and achieve economies of scale. An example of a horizontal merger is the merger between Disney and 21st Century Fox, which allowed Disney to expand its content library and compete more effectively in the entertainment industry.

Vertical Merger

In a vertical merger, companies operating at different stages of the production process within the same industry come together. This type of merger can help streamline operations, reduce costs, and improve efficiency. An example of a vertical merger is the merger between AT&T and Time Warner, where AT&T acquired a content provider to enhance its offerings and gain a competitive edge in the telecommunications industry.

Conglomerate Merger

A conglomerate merger involves the combination of companies that are in unrelated industries. This type of merger allows companies to diversify their business interests and reduce risks associated with being too heavily focused on one industry. An example of a conglomerate merger is the merger between Berkshire Hathaway and Dairy Queen, where Berkshire Hathaway expanded its portfolio to include a fast-food chain, diversifying its investments.Each type of merger has its own set of advantages and disadvantages.

Horizontal mergers can lead to increased market power but may face antitrust scrutiny. Vertical mergers can improve efficiency but may raise concerns about monopolistic behavior. Conglomerate mergers can offer diversification benefits but may result in challenges related to managing unrelated business units effectively.

Due Diligence in Mergers and Acquisitions

Due diligence is a crucial step in the M&A process as it involves a comprehensive investigation and analysis of the target company to assess its financial, legal, and operational health. This process helps the acquiring company make informed decisions and mitigate risks associated with the transaction.

Importance of Due Diligence

Due diligence is essential in M&A transactions to uncover any potential issues or risks that may impact the success of the deal. It allows the acquiring company to evaluate the target company’s assets, liabilities, financial performance, legal compliance, and overall business operations.

Steps Involved in Conducting Due Diligence

1. Planning: Define the scope of due diligence and gather necessary information. 2. Information Request: Request relevant documents and data from the target company. 3.

Review and Analysis: Examine financial statements, contracts, legal documents, and operational processes. 4. Identify Risks: Assess potential risks and liabilities that may affect the transaction. 5. Reporting: Compile findings and present a due diligence report to key stakeholders.

Role of Legal, Financial, and Operational Due Diligence

Legal Due Diligence:Involves reviewing contracts, litigation history, intellectual property rights, compliance issues, and regulatory matters to ensure legal risks are identified and addressed.

Financial Due Diligence:Focuses on analyzing the target company’s financial statements, cash flow, profitability, debt obligations, and any potential financial risks that may impact the deal.

Operational Due Diligence:Examines the target company’s operational processes, supply chain, technology infrastructure, human resources, and other key operational aspects to assess efficiency and identify areas for improvement.

Valuation Methods in Mergers and Acquisitions

Valuation methods play a crucial role in determining the worth of a company involved in a merger or acquisition. It helps in assessing whether the deal is financially viable and beneficial for all parties involved.

Different Valuation Methods

There are several valuation methods used in M&A deals, including:

- Comparable Company Analysis (CCA): This method involves comparing the target company with similar publicly traded companies to determine its value.

- Discounted Cash Flow (DCF) Analysis: DCF analysis estimates the value of a company based on its projected future cash flows, discounted back to present value.

- Asset-Based Valuation: This method focuses on the company’s tangible and intangible assets to determine its overall value.

- Market Capitalization: Market capitalization is calculated by multiplying the company’s current share price by its total number of outstanding shares.

Comparison of DCF Analysis with Comparable Company Analysis

In comparing DCF analysis with CCA, it is essential to note that:

- DCF Analysis: DCF analysis is forward-looking and focuses on future cash flows, making it suitable for companies with stable and predictable cash flows.

- Comparable Company Analysis: CCA relies on historical data and market multiples of similar companies, making it more suitable for companies with comparable peers in the market.

- Both methods have their strengths and limitations, and a combination of both can provide a more comprehensive valuation.

Impact of Valuation on Mergers and Acquisitions

Valuation directly impacts the success of mergers and acquisitions in several ways, including:

- Setting the Purchase Price: Valuation methods help in determining the fair purchase price for the target company, ensuring that the deal is financially beneficial for the acquiring company.

- Decision-Making: Valuation plays a crucial role in decision-making processes during M&A deals, guiding companies on whether to proceed with the transaction or not.

- Post-Merger Integration: A proper valuation ensures that the post-merger integration process is smooth and successful, as it provides a clear understanding of the target company’s value and assets.

Regulatory Issues in Mergers and Acquisitions

Regulatory issues play a crucial role in the process of mergers and acquisitions, particularly concerning antitrust concerns and government oversight. These issues can significantly impact the success or failure of M&A transactions.

Antitrust Concerns in Mergers and Acquisitions

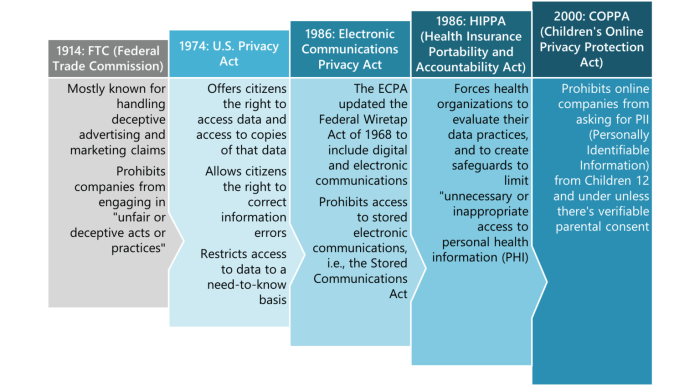

Antitrust concerns arise when mergers and acquisitions result in a significant reduction in competition within a specific market. This reduction in competition can lead to higher prices, reduced innovation, and limited consumer choices. Government agencies, such as the Federal Trade Commission (FTC) and the Department of Justice (DOJ), closely monitor M&A transactions to ensure they comply with antitrust laws.

- Companies involved in M&A transactions must undergo antitrust scrutiny to determine if the merger or acquisition would create a monopoly or substantially lessen competition.

- Antitrust issues can arise when two major competitors in the same industry merge, potentially leading to a dominant market position.

- Regulators may require companies to divest certain assets or make other concessions to address antitrust concerns and gain approval for the transaction.

Role of Government Agencies in Regulating M&A Transactions

Government agencies, such as the FTC and the DOJ in the United States, play a critical role in regulating M&A transactions to protect competition and consumers’ interests. These agencies review proposed mergers and acquisitions to ensure they comply with antitrust laws and do not harm market competition.

- The FTC and DOJ have the authority to investigate and challenge M&A transactions that raise antitrust concerns, ultimately seeking to prevent anti-competitive behavior.

- These government agencies review the potential impact of a merger or acquisition on market competition, pricing, and consumer choice to determine if regulatory intervention is necessary.

- Regulators may impose conditions on M&A transactions, such as requiring companies to divest certain assets or businesses, to address antitrust concerns and promote competition.

Examples of High-Profile M&A Deals Facing Regulatory Scrutiny

Several high-profile mergers and acquisitions have faced regulatory scrutiny due to antitrust concerns and potential impacts on market competition. Some notable examples include:

- The proposed merger between AT&T and Time Warner faced regulatory challenges, with the DOJ filing a lawsuit to block the deal on antitrust grounds. The case ultimately went to court, where the merger was approved with certain conditions.

- Facebook’s acquisition of Instagram and WhatsApp also attracted regulatory scrutiny, with concerns raised about the social media giant’s growing market power and potential anti-competitive behavior. Regulators continue to monitor Facebook’s acquisitions and business practices.

- The merger between Staples and Office Depot was blocked by the FTC due to antitrust concerns, as the combined company would have controlled a significant portion of the office supply market, potentially harming competition.

Cultural Integration in Mergers and Acquisitions

Cultural integration plays a crucial role in the success of mergers and acquisitions. When two companies come together, they bring their own unique organizational cultures, values, and ways of working. Failing to address cultural differences can lead to employee disengagement, lack of collaboration, and ultimately, the failure of the merger or acquisition.

Importance of Cultural Fit

Having a strong cultural fit is essential for the successful integration of companies in mergers and acquisitions. It helps in aligning the values, beliefs, and behaviors of both organizations, creating a cohesive and unified work environment. This, in turn, leads to higher employee morale, increased productivity, and better business outcomes.

Strategies for Managing Cultural Differences

Several strategies can be employed to manage cultural differences during the integration process:

- Conduct cultural assessments to understand the cultural nuances of each organization.

- Communicate openly and transparently about the changes and expectations.

- Establish a cultural integration team to lead the process and address any challenges that arise.

- Organize cross-cultural training programs to educate employees about the new culture and foster understanding.

- Create opportunities for employees from both organizations to collaborate and build relationships.

Challenges of Cultural Integration in Cross-Border M&A Transactions

When companies from different countries come together in a merger or acquisition, the challenges of cultural integration are amplified:

- Language barriers can hinder effective communication and collaboration.

- Differences in work practices, values, and norms may lead to conflicts and misunderstandings.

- Legal and regulatory differences between countries can complicate the integration process.

- Cultural biases and stereotypes may impact decision-making and employee morale.

Post-Merger Integration

Mergers and acquisitions are complex processes that involve integrating two separate entities into a single cohesive organization. The post-merger integration phase is crucial for the success of the deal, as it determines how well the two companies will work together moving forward.

Key Steps in Post-Merger Integration

Post-merger integration involves several key steps that need to be carefully planned and executed. Some of the essential steps include:

- Developing a detailed integration plan outlining timelines, responsibilities, and milestones.

- Aligning the organizational structures of both companies to eliminate redundancies and streamline operations.

- Implementing a communication strategy to keep employees informed and engaged throughout the integration process.

- Integrating IT systems and processes to ensure seamless operations and data sharing.

- Establishing a strong corporate culture that promotes collaboration and teamwork across the newly merged organization.

Importance of Effective Communication During Integration

Effective communication is crucial during the post-merger integration phase to ensure that all stakeholders are on the same page and aligned with the company’s goals. Clear and transparent communication helps to mitigate uncertainty and resistance among employees, fostering a sense of trust and unity within the organization.

Best Practices for Successful Post-Merger Integration

Some best practices for successful post-merger integration include:

- Establishing a dedicated integration team with representatives from both companies to oversee the process.

- Setting clear and measurable integration goals to track progress and ensure accountability.

- Providing comprehensive training and support to employees to help them adapt to the changes and new roles within the organization.

- Celebrating milestones and successes during the integration process to boost morale and maintain momentum.

- Seeking feedback from employees and stakeholders to address any concerns or issues that may arise during the integration.

Mergers and Acquisitions in the Tech Industry

The tech industry has been a hotbed for mergers and acquisitions (M&A) activity in recent years, driven by various trends and factors. Technology companies often use M&A as a strategic tool to gain a competitive edge, expand their market reach, acquire new technologies or talent, and stay ahead of the competition.

These mergers and acquisitions can have a significant impact on innovation, market dynamics, and the overall landscape of the tech sector.

Trends and Drivers of M&A Activity in the Tech Sector

M&A activity in the tech industry is driven by several trends, including the constant need for innovation, rapid technological advancements, changing consumer preferences, and the desire to scale operations quickly. Companies often turn to M&A to acquire cutting-edge technologies, intellectual property, or specialized talent that can help them stay ahead in a highly competitive market.

- Strategic Partnerships: Tech companies form strategic partnerships through mergers and acquisitions to combine their strengths, resources, and expertise to drive innovation and create new products or services.

- Market Consolidation: M&A activity in the tech sector often leads to market consolidation, with larger companies acquiring smaller ones to increase their market share and competitive advantage.

- Global Expansion: Technology companies use M&A as a means to enter new markets, expand their customer base, and diversify their product offerings to stay relevant in a fast-evolving industry.

Impact of Tech Mergers on Innovation and Market Dynamics

Tech mergers can have a profound impact on innovation and market dynamics, shaping the competitive landscape and driving industry trends. By combining their resources, expertise, and technologies, merging companies can accelerate innovation, develop new products or services, and bring them to market faster than they could on their own.

- Accelerated Innovation: Mergers and acquisitions in the tech industry often lead to accelerated innovation, as companies pool their resources and expertise to develop cutting-edge technologies and solutions.

- Market Disruption: Tech mergers can disrupt the market dynamics by introducing new players, technologies, or business models that challenge the status quo and force competitors to adapt or innovate to stay competitive.

- Enhanced Competition: M&A activity in the tech sector can intensify competition, as companies strive to outperform rivals, capture market share, and establish themselves as leaders in emerging technologies or markets.

Global Trends in Mergers and Acquisitions

The global landscape of mergers and acquisitions is constantly evolving, influenced by various factors such as economic conditions, technological advancements, and regulatory changes. Understanding the current trends in M&A can provide valuable insights into the future direction of the industry.

Impact of Geopolitical Factors on Cross-Border M&A Transactions

Cross-border M&A transactions are significantly affected by geopolitical factors such as trade policies, tariffs, and political instability. These factors can create uncertainties and risks for companies looking to expand internationally through acquisitions. For example, changes in diplomatic relationships between countries can impact the success and feasibility of cross-border deals.

Companies must carefully assess and mitigate geopolitical risks when engaging in such transactions to ensure successful outcomes.

Outlook for M&A Activity in Different Regions

M&A activity varies across different regions around the world based on economic conditions, market trends, and regulatory environments. For instance, emerging markets like Asia-Pacific are experiencing a surge in M&A activity driven by growing economies and increasing investor interest. On the other hand, mature markets in Europe and North America are witnessing a more stable but competitive M&A landscape.

Understanding the regional nuances and opportunities is crucial for companies seeking to capitalize on M&A trends in specific markets.

Summary

As we conclude our journey through the realm of Mergers and Acquisitions, we are left with a profound appreciation for the complexities and rewards that come with strategic business partnerships. From due diligence to post-merger integration, each step in this process unveils a new layer of understanding and possibility.

May the lessons learned here inspire future endeavors and pave the way for success in the ever-evolving world of M&A.